In what ways do past competition cases, like Apple vs. Spotify, illustrate the practical application and potential effectiveness of the Digital Markets Act? What are the limits?

Written by Yassine Besseghir

On the 1st of November 2022 the Digital Market Act entered into force and become applicable on 2 May 2023. As it is stated on the European Commission webpage, “The Digital Markets Act is the EU’s law to make the markets in the digital sector fairer and more contestable”. Firstly, “Fairer” as it aims to rebalance bargaining power in favor of end customers and business users for a more equitable distribution of platform-created value. Secondly, “Contestable”, as it would enhance market competition, benefiting potential entrants and fostering innovation.

“I like economics because it is a structured way to understand the world, to relate things affecting us. I enjoy how economics can allow us to describe the world, to understand the mechanisms. I also appreciate modeling them, it is a very challenging exercise. “

Who is concerned by the DMA:

Gatekeepers are the largest and most influential digital platforms in Europe. A platform can be designated as a gatekeeper if it meets specific quantitative criteria related to its financial scale, geographical presence in Europe, and the size of its active user and business user base. They are typically designed to target the most influential platforms such as Gafam.

However, a gatekeeper can contest the quantitative criteria by demonstrating that they do not meet qualitative criteria. These criteria include having a significant economic impact on the EU market, holding an important and unavoidable intermediation position to reach European users, and maintaining a well-anchored and durable position.

Once a platform is designated as a gatekeeper, the DMA will regulate its core platform services.

These digital services grant the platform considerable power due to several factors: strong network effects, the ability to connect numerous users, creating significant dependence for both business users and end customers, inducing lock-in effects, or possessing data-driven advantages. That is how the list of the following core platforms services has been done. Windows (Microsoft), Booking.com (Booking), Google play (Google), Safari (Apple), TikTok (Byte Dance), Google Ads, Meta.

In cases of infringement, a platform can be fined up to 10% of the company's total worldwide annual turnover. Remedies may be imposed, and even the divestiture of a business can be ordered.

Obligations imposed on Gatekeepers :

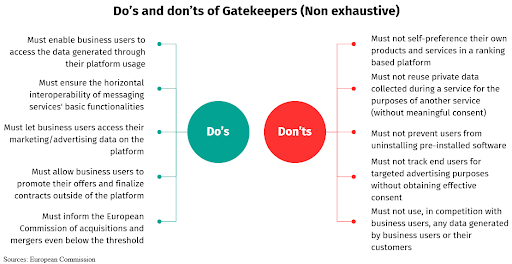

For competitive concerns, platforms must adhere to a set of obligations. They are generally called “Do’s and Don’ts”, its main points are the following:

Ban on anti-steering interdiction: the Apple store vs Spotify case

The present case illustrates accurately the situation prior to the DMA, and it significantly influenced some aspects of Article 5 of the DMA.

In 2024, the European Union fined Apple €1.8 billion for unfair trading practices related to its App Store, following a complaint by Spotify in 2019. The European Commission found that Apple had imposed "anti-steering provisions" preventing app developers from informing users about alternative payment methods. This practice ensured Apple’s 30% commission on all purchases made through the App Store. Initially, Spotify's complaint focused on this commission. They argued that it made their service less competitive than Apple Music because the commission artificially maintained their prices high. However, the European Commission reformulated its charges in 2023 to focus on the anti-steering provisions and their direct harm to consumers.

“Instead of looking first at what anti-steering does to Apple competitors and then consumers, we now focus more directly on harm to consumers.”

Ms. Vestager

(Executive Vice-President for A Europe Fit for the Digital Age and Competition, European Commission).

The European commission demonstrated that this situation caused harm to users. Indeed, Spotify might pass this fee to end users. This led to monetary harm, as users paid significantly higher prices for music streaming subscriptions due to Apple’s high commission fee. While, as it did in 2016, Spotify has chosen to disable in-app subscriptions entirely. This constitutes non-monetary harm, leading to a degraded user experience where users either had to search extensively to find relevant offers outside the app or never subscribed to any service because they couldn’t find the right one on their own.

This case likely inspired much of Article 5 of the DMA. According to Article 5(4), app developers on the App Store such as Spotify, for instance, must be allowed to promote their offers and finalize contracts with customers directly. This allows Spotify to promote their own external websites. Additionally, Article 5(5) states, “The gatekeeper shall allow end users to access and use, through its core platform services, content, subscriptions, features, or other items, by using the software application of a business user.” In practice, this provision prevents Apple from blocking subscriptions acquired outside the App Store. Finally, Article 5(7) mandates that platforms cannot require business or end users to rely on the gatekeeper’s web browser engine, identification, or payment services, thereby allowing Spotify to use its own payment service instead of Apple's.

Under the current DMA, if this case were to occur, there would be no requirement for extensive market investigations, economic analyses, or lengthy processes.

Apple's conduct would clearly constitute a violation of the DMA, constituting a restriction of competition by object and leading to immediate sanctions.

The criticism surrounding the DMA

One of the primary goals of the DMA is to foster innovation, but certain obligations within the regulation have been criticized for potentially hindering this objective.

For instance, in November 2023, Meta responded to the DMA by implementing a 'pay or consent' policy on its social media platform, Facebook. This policy forces European users to choose between using the app for free while consenting to the collection and use of their personal data for commercial purposes, or paying a monthly fee for an ad-free experience. The European Commission has raised concerns that Meta's "pay or consent" policy may not comply with the DMA. According to Article 5(2) of the DMA, if a user declines to consent to the use of their personal data, the platform should provide a less personalized but equivalent use of the service. However, this poses a significant challenge for Meta, given that:

Approximately 99% of the year's total revenue was advertising revenue.

which is central to its business model (Investopedia, 2023). This situation forces platforms like Meta into a dilemma where their business model may not be sustainable under DMA regulations. They provide a service that can only be monetized effectively through targeted advertising or a subscription model. Without these options, their business viability and innovation capacity are endangered. To illustrate, Apple chose to not release Apple Intelligence AI to the European Union because, as they said, “we are concerned that the interoperability requirements of the DMA could force us to compromise the integrity of our products in ways that risk user privacy and data security”.

This decision divests European customers and business users from this innovation and all the economic spillovers associated with it.

On another hand, some would like to say that there is also a moral question at play here where big power comes with big responsibility, which should sometimes overpass mere profit considerations. In today's digital landscape, users have become increasingly dependent on platforms for their daily interactions, they are likely to use it and lower their standards in terms of user protection. Isn’t the role of a regulator to make companies internalize this duty that may not be considered otherwise?

Conclusion

To sum up, the DMA represents a crucial move towards regulating gatekeepers. Prior to its implementation, platforms that benefited from their natural monopolies, often through a "winner takes all" dynamic, were able to dictate the rules. While the GDPR was an important step in protecting user data, it was not enough to adequately address the power imbalances that platforms have accumulated during their rapid expansion. However, criticisms have surfaced regarding potential over-regulation by the European Commission, which may not fully grasp the intricacies of business models within specific sectors. Each sector of the digital economy operates under its unique dynamics. What works for one may not be suitable or effective for another.

Hence, over-regulation can potentially hinder the competitive edge and agility that are vital for digital innovation.

More Articles

At a Crossroads: Europe's Weaknesses and Future in the Draghi Report

By: Du Breil Lucie

On September 9th, Mario Draghi, former president of the European Central Bank, derived its findings about the economic future of “The Old Continent”, like a ticking bomb. It presents a sharp analysis of Europe’s economic competitiveness, highlighting the strengths and the incoming challenges ...

Mental and intellectual disabilities on the labor market

By: Desbabel Chloé and Doville Léopold

The 28th European Week for the Employment of People with Disabilities will take place from November 18 to 24, 2024. Between 20% and 30% of people across Europe report having some form of disability that impacts their daily activities...

The Fed’s Finest Hour

By: E.Flandin, V.Belleux and P.Rossignol

The central bank, often unknown to the general public, plays a crucial role in regulating and stabilizing the economy of a country, or a continent. Its main objectives are to regulate inflation and help the economy operate “smoothly” using various levers.These tools can be used for economic stimulus, such as setting key interest rates, which determine lending conditions for banks...

Why Are Monopolies Hard to Dismantle in the United States?

By: Echerfaoui Laila

This year, Professor Michael D.Whinston was awarded the Jean-Jacques Laffont Prize for his significant work on antitrust laws and his involvement in the Google monopoly case. After going through his main publications, news reports about him, and videos on the Google case, I started wondering: why are monopolies so hard to dismantle in the U.S. ...