The Fed’s Finest Hour

Written by Enzo FLANDIN, Victor BELLEUX and Pierre ROSSIGNOL

Inside the Fed Machine

The central bank, often unknown to the general public, plays a crucial role in regulating and stabilizing the economy of a country, or a continent. Its main objectives are to regulate inflation and help the economy operate “smoothly” using various levers. These tools can be used for economic stimulus, such as setting key interest rates, which determine lending conditions for banks and, consequently, for businesses and households.

In addition to these missions, the central bank’s core function is to issue currency (euros, yen, US dollars), guaranteeing trust in it and modulating its quantity in the economy. It also serves as the lender of last resort if banks become too weakened during an economic crisis.

In this article, we will discuss the case of the Federal Reserve (Fed), the Central Bank of the United States. The Fed was established on December 23, 1913, with the signing of the Federal Reserve Act by President Woodrow Wilson. Its creation responded to an urgent need to stabilize the American banking system, which was plagued by recurring crises. Currently, Chairman Jerome Powell is the director of the Fed. The Federal Reserve's Board of Governors and the Federal Open Market Committee aim to manage long-term growth in money and credit to support the economy’s production growth potential, promoting maximum employment, stable prices, and moderate long-term interest rates.

After this brief introduction, we will present how the Fed acted during the pandemia. Then we will focus on how and which tools it has used since and finally we will deal with its current challenges..

“I like economics because it is a structured way to understand the world, to relate things affecting us. I enjoy how economics can allow us to describe the world, to understand the mechanisms. I also appreciate modeling them, it is a very challenging exercise. “

The Fed’s Covid Crucible

During the Covid-19 crisis, the entire world was paralyzed by uncertainty regarding the effects of the virus. This triggered a major economic shock in the United States and worldwide. Businesses experienced an unprecedented drop in activity due to lockdowns and reduced demand for goods and services. In April 2020, the U.S. unemployment rate reached 14.7%, far exceeding the peak after the 2008 subprime crisis, which was 10.2%. Most of the available assets in the markets collapsed due to these drastic measures. The Dow Jones, a major U.S. index, fell by more than 30% within a month. Additionally, small and medium-sized enterprises suffered from cash flow problems due to economic instability.

Therefore, the Fed took emergency measures to save economic actors.

First, it lowered the Federal funds rate to near zero, making borrowing nearly free, and then launched a large asset purchase program, including government bonds. This injects liquidity into the financial system, lowering bond yields and, over time, reducing borrowing costs. Lower bond yields encourage banks to lend more money to finance themselves and make profits. This increase in the supply of bank loans lowers interest rates further, in addition to a generally low-rate environment.

Moreover, the Fed introduced targeted support programs, such as the Main Street Lending Program and the Money Market Mutual Fund Liquidity Facility, to improve access to credit and stabilize financial systems.

All these measures reduced economic and financial market tensions, allowing various economic players to regain confidence.

Consequently, households’ investment, consumption, and debt levels resumed enough to restart the economy and avoid a deeper crisis.

However, any "highly" accommodative monetary policy carries medium-term risks, such as the possibility of hyperinflation, a rapid increase in prices, which could prompt the Fed to intervene to reduce inflation, contradicting a stimulus policy. There can also be speculative bubbles in financial markets, where investors, having access to low rates, could become overconfident and find themselves overleveraged in speculative positions. In the event of a bubble burst, the entire global ecosystem could be disrupted.

The Fed's Road to Stability

The prolonged maintenance of excessively low interest rates led to an inflationary surge that was difficult to control, while the unemployment rate, at its lowest level, stimulated the economy, exposing it to overheating risk. Generally, the effects of a change in interest rates are felt in the economy with a 1- to 3-year delay.

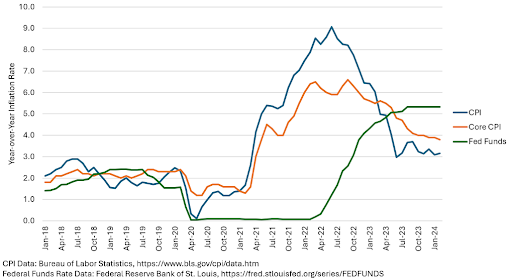

When inflation peaked at 9.1% in July 2022, it was already too late: the Federal Reserve had to rush to bring inflation back to 2%, a level considered favorable for stable growth.

The start of the Fed's rate hike cycle in 2022 eventually helped contain inflation, although it remained above the 2% target longer than expected. By mid-2023, signs of moderation appeared, although certain sectors, such as services, continued to face inflationary pressures.

At the same time, the Fed’s actions slowed economic growth and cooled the job market, narrowly avoiding a recession. The goal was to achieve a "soft landing," controlling inflation without causing a marked increase in unemployment or severe economic slowdown. Financial markets also adapted to higher interest rates, increasing borrowing costs for consumers (mortgages and credit cards) and businesses. This situation slowed down the real estate market, a sector highly sensitive to rate changes, and complicated financing for companies.

Today, with inflation under control, the Fed is beginning the second phase of its monetary cycle: lowering rates. Still aiming for a "soft landing," forecasts, such as those from Goldman Sachs, estimate a 15% risk of recession within the next 12 months.

Soft Landing

As previously mentioned, the Fed has successfully achieved its goals. Inflation has dropped to 2.4%, roughly to its target. However, the economy and the job market are becoming increasingly tight; although levels remain decent, the Fed’s goal is to manage the economic slowdown.

This has been achieved in the services sector, where the ISM Services PMI reached 54.9 points, indicating great strength in this sector. From a manufacturing standpoint, the ISM manufacturing index fell below 50, to 47.2 points in September 2024. Despite the resilience of services, the Fed must still monitor the manufacturing sector, as a crisis in one sector could trigger a global crisis.

Currently, the Fed is slowly lowering its rates to address this issue; the goal of this maneuver is to smoothly revive the economy to avoid a severe recession and prevent inflation from rising again. Rising inflation would push the Fed to raise rates again, which, in an economy teetering on recession, would be the worst-case scenario and would likely remind Fed chair Jerome Powell of the inflation shock of the '70s. During that period, oil prices soared due to the oil shocks of 1973 and 1979, fueling the inflation bubble across all types of products, prompting the Fed to raise rates between 10% and 15% from 1974 to 1975. Seeing "progress" in inflation control, Governor William Miller decided to lower rates sharply while inflation was still uncontained.

Faced with an inflation peak of 14.8% in 1980, the new Governor Paul Volcker raised the Federal funds rate to 20% to slay the inflation dragon. This plunged the U.S. into a deep recession, causing the GDP growth rate to fall to -2% in 1980.

In conclusion, the Federal Reserve's response to the Covid-19 crisis stabilized the economy through rate cuts and asset purchases. While effective, these actions led to inflationary pressures, requiring the Fed to raise rates to control inflation. As the economy slows, the Fed is cautiously lowering rates to avoid a recession and maintain stability. This approach reflects the lessons from past crises, aiming for a balanced recovery without triggering further economic instability.

More Articles

The practical application, potential effectiveness and limits of the Digital Markets Act

By: Besseghir Yassine

On the 1st of November 2022 the Digital Market Act entered into force and become applicable on 2 May 2023. As it is stated on the European Commission webpage, “The Digital Markets Act is the EU’s law to make the markets in the digital sector fairer and more contestable”....

At a Crossroads: Europe's Weaknesses and Future in the Draghi Report

By: Du Breil Lucie

On September 9th, Mario Draghi, former president of the European Central Bank, derived its findings about the economic future of “The Old Continent”, like a ticking bomb. It presents a sharp analysis of Europe’s economic competitiveness, highlighting the strengths and the incoming challenges ...

Mental and intellectual disabilities on the labor market

By: Desbabel Chloé and Doville Léopold

The 28th European Week for the Employment of People with Disabilities will take place from November 18 to 24, 2024. Between 20% and 30% of people across Europe report having some form of disability that impacts their daily activities...

Why Are Monopolies Hard to Dismantle in the United States?

By: Echerfaoui Laila

This year, Professor Michael D.Whinston was awarded the Jean-Jacques Laffont Prize for his significant work on antitrust laws and his involvement in the Google monopoly case. After going through his main publications, news reports about him, and videos on the Google case, I started wondering: why are monopolies so hard to dismantle in the U.S. ...