At a Crossroads: Europe's Weaknesses and Future in the Draghi Report

Written by Lucie du Breil

On September 9th, Mario Draghi, former president of the European Central Bank, presented its findings on the economic future of “The Old Continent”, like a ticking bomb. It presents a sharp analysis of Europe’s economic competitiveness, highlighting the strengths and the incoming challenges that need to be addressed to build a prosperous and inclusive future.

Yet, Europe has the strength to become a highly competitive economy. Accounting for 16% of global GDP in 2023 according to the IMF, it is made up of around 440 million consumers and 23 million companies. Moreover, it has active policies working to reduce inequality, redistribute wealth, and fight against poverty. For instance, in 2021, the European Commission aimed to reduce the number of people living in poverty to less than 15 million by 2030.

However, achieving ambitious goals such as social inclusion, maintaining political relevance on the international stage especially during conflicts or trying to achieve carbon neutrality to face climatic change is deeply intertwined with economic growth.

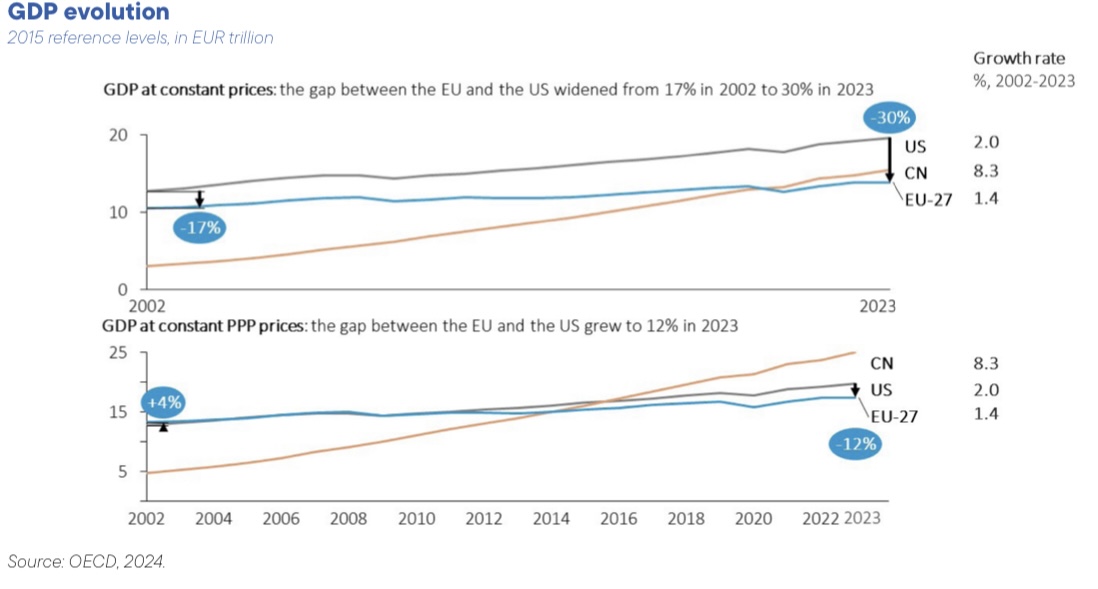

Draghi’s report highlights the loss of speed in Europe’s growth compared to the US. In the past two decades, the gap between the American and European GDP has doubled, from 15% to 30% as the figure shows. It is mentioned that 70% of this gap could be explained by productivity divergence. This gap has major consequences on European consumers, especially in terms of purchasing power.

Since 2000, real disposable income has nearly doubled in terms of growth in the US compared to the EU.

Hence, it is associated with a weaker demand in Europe. Productivity is a key challenge that must be addressed, especially regarding investments and innovation.

"Research and Innovation in Europe have remained static over the last two decades".

Mario Draghi

Former Prime Minister of Italy

while in the US, the focus has shifted from the pharmaceutical industry to the digital sector.

Economist Elie Cohen, Research Director at the CNRS, highlights a technology-intensive environment in the US characterized by massive R&D investments, collaboration, specialized funding institutions, research laboratories oriented toward applications, closely connected to universities… Moreover, he points out that when an innovation emerges in the US, it immediately finds a unified market, while in Europe, innovations face a fragmented collection of smaller markets.

Furthermore, Economist David Cavla, Senior Lecturer at Angers University, attributes this investment gap to Europe’s limited structural policies and commercial strategies. He states that the EU is primarily a market for consumers and was built on the idea that, by targeting dominant positions and preventing the emergence of national champions, a unique European market could be created.

In addition to these market complexities, Europe now faces a major challenge: the high cost of energy.

According to the report, around 50% of companies perceived high energy costs as a barrier to investment and, consequently, to economic growth.

Europe relies heavily on imports and is the world’s largest importer of gas and liquefied natural gas. This situation is distinct from that of the US, which has access to energy resources like shale gas. Such dependence on imported resources makes Europe vulnerable to external shocks, highlighting the need for decarbonization. But as decarbonization involves the development of both nuclear and renewable energy, the hurdle is to achieve it without compromising the industry competitiveness with higher costs.

To address these challenges, the report makes recommendations across various areas, including health, energy, defense, and AI. The goal is to restore competitiveness through investment and innovation rather than cost-cutting measures like wage reductions. However, some member states may be hesitant, as they rely on an export-led growth model and so the short-run costs of investment are perceived as detrimental to them.

Here are some of the recommendations:

- Sustaining investment: “Reduce fragmentation of the Single Market removing barriers for innovation, company growth and large infrastructure projects in Europe – thereby, increasing demand for risk capital and for higher volumes of finance through capital market.”

- Energy: “Lower and level the energy taxation playing field and the strategic use of taxation measures to reduce the cost of energy.”, “Develop the governance needed for a true Energy Union.”

- IA: “Increase the computational capacity dedicated to the training and fine-tuning of AI models and create an EU-wide framework for providing ‘computing capital’ to innovative SMEs in the EU”

- Transport: “Improve infrastructure planning with a primary focus on competitiveness as a ST complement to cohesion and an evolution towards fully multimodal transport”

- Semiconductor: “Enable the development of a new EU Semiconductor Strategy, by establishing an ST/MT EU semiconductor budget, coordinating demand requirements, introducing EU preferences in procurement and a new ‘fast-track’ IPCEI”

The main concern regarding all these recommendations is the way to finance them.

Europe relies heavily on imports and is the world’s largest importer of gas and liquefied natural gas. This situation is distinct from that of the US, which has access to energy resources like shale gas. Such dependence on imported resources makes Europe vulnerable to external shocks, highlighting the need for decarbonization. But as decarbonization involves the development of both nuclear and renewable energy, the hurdle is to achieve it without compromising the industry competitiveness with higher costs.

To address these challenges, the report makes recommendations across various areas, including health, energy, defense, and AI. The goal is to restore competitiveness through investment and innovation rather than cost-cutting measures like wage reductions. However, some member states may be hesitant, as they rely on an export-led growth model and so the short-run costs of investment are perceived as detrimental to them.

Here are some of the recommendations:

- Sustaining investment: “Reduce fragmentation of the Single Market removing barriers for innovation, company growth and large infrastructure projects in Europe – thereby, increasing demand for risk capital and for higher volumes of finance through capital market.”

- Energy: “Lower and level the energy taxation playing field and the strategic use of taxation measures to reduce the cost of energy.”, “Develop the governance needed for a true Energy Union.”

- IA: “Increase the computational capacity dedicated to the training and fine-tuning of AI models and create an EU-wide framework for providing ‘computing capital’ to innovative SMEs in the EU”

- Transport: “Improve infrastructure planning with a primary focus on competitiveness as a ST complement to cohesion and an evolution towards fully multimodal transport”

- Semiconductor: “Enable the development of a new EU Semiconductor Strategy, by establishing an ST/MT EU semiconductor budget, coordinating demand requirements, introducing EU preferences in procurement and a new ‘fast-track’ IPCEI”

The main concern regarding all these recommendations is the way to finance them.

"Achieving the objectives requires an annual minimum of €750-800 billion, which represents about 4.4-4.7% of the EU's GDP".

Mario Draghi

Former Prime Minister of Italy

“One potential solution is to mobilize the significant savings available in Europe. Economist Anne-Sophie Alsif from BDO France has mentioned that it is possible to reach the €800 billion target by mobilizing 20-30% of those savings. However, this remains complicated for the moment due to a lack of capital mobility within the EU.

To overcome this difficulty, M. Draghi has suggested a communal loan, similar to the approach taken during COVID-19. During the cohesion episode, EU countries borrowed about €700 billion over seven years, whereas this proposal recommends annual borrowing. Furthermore, there is currently no political agreement on repayment among the 27, as mentioned by Béatrice Mathieu, Senior reporter at L'Express responsible for economic affairs. This proposal has sparked various reactions within the EU, particularly from the frugal states and Germany.

"The mutualization of debts can also lead to an excessively high overall borrowing within the European Union. Each member state of the European Union must continue to take responsibility for its own public finances."

Christian Lindner

German Federal Minister of Finance

This reaction is expected, considering that they were previously concerned about the common loan for COVID-19, which reflects these countries' commitment to budgetary rigor. The mandate of the ECB has also been significantly influenced by the Bundesbank, which recalls the episode of German hyperinflation.

In conclusion, as Elie Cohen emphasizes, a strong political consensus among European countries is essential to develop an integrated industrial strategy. This collaboration between European and national levels will be vital in establishing effective financing tools to support innovation and competitiveness. Draghi’s report offers a comprehensive analysis and strong recommendations. The challenge for Europe lies in its ability to combine the strengths of its member states to build a new vision based on economic federalism.

More Articles

The practical application, potential effectiveness and limits of the Digital Markets Act

By: Besseghir Yassine

On the 1st of November 2022 the Digital Market Act entered into force and become applicable on 2 May 2023. As it is stated on the European Commission webpage, “The Digital Markets Act is the EU’s law to make the markets in the digital sector fairer and more contestable”....

Mental and intellectual disabilities on the labor market

By: Desbabel Chloé and Doville Léopold

The 28th European Week for the Employment of People with Disabilities will take place from November 18 to 24, 2024. Between 20% and 30% of people across Europe report having some form of disability that impacts their daily activities...

The Fed’s Finest Hour

By: E.Flandin, V.Belleux and P.Rossignol

The central bank, often unknown to the general public, plays a crucial role in regulating and stabilizing the economy of a country, or a continent. Its main objectives are to regulate inflation and help the economy operate “smoothly” using various levers.These tools can be used for economic stimulus, such as setting key interest rates, which determine lending conditions for banks...

Why Are Monopolies Hard to Dismantle in the United States?

By: Echerfaoui Laila

This year, Professor Michael D.Whinston was awarded the Jean-Jacques Laffont Prize for his significant work on antitrust laws and his involvement in the Google monopoly case. After going through his main publications, news reports about him, and videos on the Google case, I started wondering: why are monopolies so hard to dismantle in the U.S. ...